What is savings ? The amount left with a person after deducting all the expenses is called savings. Any child can tell that . But why am I talking about that in the first place ? This is because I am from India and majority of the Indians don’t like to invest in risky places and prefer to keep their savings in traditional places like fixed deposits ,recurring deposits in banks and post offices even when they give no absolute returns.

Let us make a list of places where a normal salaried person can save and park their money for returns:

- Savings account- This is the most common and primary place where the normal citizen can park their funds. Savings account provide returns ranging from 2.5 % to 7% depending on the time(duration of the deposit) and bank.

I have written a article on this previously also .You can check it here https://sidworld.in/8-best-places-for-investment-in-india/ .But in this article ,I want to explain something different.

2) Recurring deposits- This is a type of investment where a person can invest on a monthly basis in banks.The money is deducted directly from the bank account to the recurring account.The interest rate is usually 6 to 7 % on an annual basis.

3) Post Office – This is also a place where many people invest .It has savings schemes like fixed deposit , recurring deposit just like in banks and also Public Provident Fund and National Savings Certificate .You can visit its website here https://www.indiapost.gov.in/Financial/pages/content/post-office-saving-schemes.aspx

4) Real Estate – Investment in real estate is also a very good investment. Once it is acquired ,it gives return for a long time with increase in value. Real estate is of 2 types – One is organized like we buy apartments and office spaces from the developer and the other is unorganized like we buy land directly from the land owner and carry out the construction ourselves. But the only drawback is that it requires large capital at a time .It is not affordable for everyone.

5) Share Market – Share market is a place which shows us the true power of savings and investment. Everybody in India saves somewhere for their future like in FD, RD and Post Office schemes as stated above. But what returns do they get ? Maximum 7- 8 % per annum . India has more than 100 lakh crore in fixed deposits and is considered the biggest wealth destroyer .I know people who are working as an employee in a government bank (considered safe in India) and put their savings in fixed deposit because they are safe. Compare this situation to another one .

There is a business family in India called Shapoorji Pallonji Group. Its founder is Shapoorji Mistry. He had a real estate business in 1858 and built many landmark buildings in India including Reserve Bank of India’s building in Mumbai. His son was Pallonji Mistry and he started investing in Tata group business in 1931 by buying the share of Tata Sons which is the holding company of all the Tata companies.As of 2022, it had a stake of over 18 % which makes it the largest shareholder and is worth Rs.80000- 100000 crore. It will keep on increasing as the price of share move upwards.

Rakesh Jhunjhunwala ,who died last year was considered an ace investor .When Titan Company was listed in 2003 , he started buying its shares. Today he and his wife still has a stake of 5% in Titan valued at Rs.10000 crores.

There is a company in Singapore which is government owned called Temasek Holdings. It was incorporated in 1974 with a small corpus initially .It started investing in other companies all around the world and today it manages assets worth half a trillion dollars with only 900 employees. It simply invests in good companies and when the business grows, its valuation also goes up .

I am simply trying to prove that taking no risk is the biggest risk which a person takes for himself. He can at least invest in some good companies which provides him some capital appreciation. If he does not understand share markets,there is another option called mutual funds.

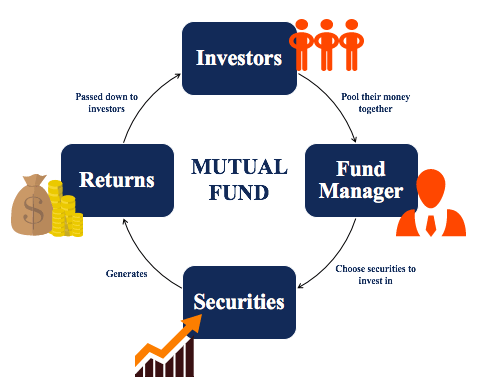

6) Mutual Funds- Mutual funds are funds which collects fund from the public and invest in capital markets but in a way which reduces the risk and also provides capital appreciation. There are a lot of guidelines made by the government which are followed by the mutual fund companies which makes it safe for the investors.If we only consider the index returns of Sensex since it was started in 1986 , it has provided CAGR of 15%.

In mutual funds we have to keep one thing in mind .Since there are 44 mutual companies and over 5000 schemes in India,so it is necessary to select good scheme with good track record. For that you need to contact an advisor .This is because everyone needs a scheme which will be beneficial for them and it varies person to person. For consultation on schemes ,you can get in touch with me https://nivesh.app.link/xIjvJSHkv9

7) Unlisted Shares- This is a platform where risk is high and returns are also high. Here, we provide the shares of any company which are available in a private market. The company will bring its IPO in the near future and then the investor will make good returns. It is like investing in a startup. When Nykaa brought its IPO ,the investment of Alia Bhatt increased by 10 times.

Many companies are available in the unlisted space like Bira91 and OYO .In Bira ,Sequoia Caital has also invested. Sequoia Capital is an American Venture Capital firm which invests in startups all around the world.It was an early investor in Apple in 1978.If you want to know more about this company ,you can click here https://en.wikipedia.org/wiki/Sequoia_Capital

Today, in this digital world ,savings and investing has become easy compared to what it was merely 10 years ago .There are a lot more options than ever .Still if we continue to be ignorant and invest in traditional places like fixed deposits ,we will have no-one but ourselves to blame in the future.

I am always thought about this, thanks for putting up.

Dear sidworld.in administrator, You always provide great examples and case studies.

Hey! Check this site full of deals!

https://www.amazoniadeals.com

Thank you for being of assistance to me. I really loved this article.

Thanks for posting. I really enjoyed reading it, especially because it addressed my problem. It helped me a lot and I hope it will help others too.

Please provide me with more details on the topic