In India,investment is not a preferred option and people are risk -averse. Nobody wants to take any risk . Neither in their investments nor in their career. But they forget that not taking risk is the biggest risk which they are taking .

Investment mindset will only be developed if people invest or do business. But in India everyone wants job, because of this mentality India has the the most number of job seekers in the world . To be exact there are 53 million unemployed people as of December 2021. Today , we will cover why people don’t want to take risks regarding their investments.

If people in India plan their finances properly and invest in right aveneues, they can easily achieve financial freedom. To know more about financial freedom visit this linkhttps://sidworld.in/5-ideas-for-financial-freedom/

The first reason people don’t take risks is because they have no knowledge. Sometimes people have no knowledge about the investment products. For many people, they have no knowledge where to invest their hard earned money .

They know only 2 places , one is the life insurance agent ,other is fixed deposit. India has 150 lakh crore worth of fixed deposit lying in the various banks. Insurance does not give the required return . The required return can be understood as some product which can beat inflation .Today as I am writing this blog ,the inflation is 7%. and fixed deposit rate is 5% in State Bank of India. So the real rate is negative. Similarly the rate of return in Recurring deposits is 6%. Still the real rate interest earned is negative .

Then comes insurance which is for a general tenure of 20 years . If Sum assured is 1 lacs and term is 20 years . And on maturity the life insurers double the money ,it still translates to a return of 5 %. Now where should one invest, so that he can earn a decent return which can beat inflation.

Life insurance is important but it should be taken for its primary purpose, i.e.life insurance https://sidworld.in/insurance/

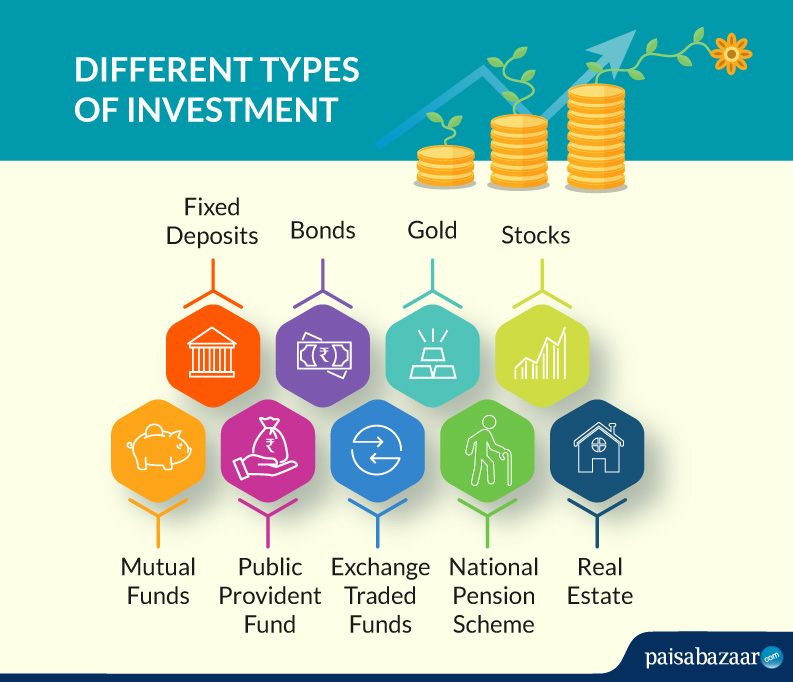

There are some places where they can invest which also beats inflation and gives decent returns .The first among them is equity. Equity market or share market gives the best returns one can ever imagine . Just to prove my point, I will give a simple example . Most of you must have heard of a company called Wipro . In 1980 if someone had invested in Wipro shares ,it would be worth 700 crore today. There are hundreds of good companies in which if people would have invested in their growth years ,they would have become rich.

Similarly the share price of Titan in 2003 was Rs 3, today’s it is Rs.2334 ,a gain of 778 times. There is another company called Bajaj Finance .Its price of 1 share in 2002 was almost Rs.6 . Today closing price was 7076. Simply put if one had bought 2000 shares worth Rs.12000, it would have become 1.41 crores today.

The other place where one can earn decent return is mutual funds . Mutual funds are a type of funds which invest in shares and debt of a company but the money is managed by a professional. It is less risky than shares but gives much more return compared to fixed deposit and recurring deposits. Mutual fund has many schemes in it like large cap fund fund ,mid cap fund , small cap fund , balanced advantage fund and various other schemes.

There are 46 Mutual fund companies, some are government bank sponsored and some are private bank sponsored. Some are foreign bank sponsored or backed by a financial institution. There are more than 6000 schemes in different mutual funds so one should invest wisely and consult a financial advisor before investing because every person’s goals are different.

Another place where one can invest is ELSS or equity linked saving scheme . It is not at all new or different .It is a type of mutual fund scheme only with some minor modifications. The difference between normal mutual fund scheme and ELSS is that there is a lock-in of 3 years in ELSS. It means investor cannot withdraw money from it before 3 years . ELSS comes under Section 80 C . Means if a person invests in this product ,he can get a tax rebate upto 150000.

For Mutual funds you can visit my bloghttps://sidworld.in/wp-admin/post.php?post=100&action=edit

Another place where one can invest is fixed deposits . I personally feel, this should only be considered by people who are above the age of 55 or more because they cannot take the risk of investing in equity because it involves risk. They need guaranteed return and safety of money which a fixed deposit can provide. But a person whose age is 40 and earning a good amount in salary and still investing in fixed deposit does not make any sense.

The forth place where one can invest is life insurance . Life insurance is also a important aspect of investment . The primary purpose of insurance is providing life cover for the bread earner of years family. Suppose a person is married with 2 kids and earning 1 lakh per month, he should get a life cover of 1 crore because if some unfortunate event happens with him , his family will get 1 crore which will take care of immediate expenses.

Of course ,in life insurance return will be low compared to equity or mutual fund but it will provide life cover if he dies unfortunately. There is no alternate to life insurance. Government on its part provides rebate in taxes upto 150000 if someone invests in insurance. It is called rebate under Section 80 C of the Income tax Act.

The fifth place where one can invest is health insurance. It does not provide any return but provides cover against any health emergencies. Some health issues keep happening in anyone’s family ,sometimes kids ,sometimes grandparents. Absence of health insurance and some medical emergency like an accident can mean expenses in lakhs and can wipe out months of savings . Government also provides some relief in taxes under Section 80D of the Income Tax Act,1961. This is in addition to Rs.1,50000 provided under 80C.

The sixth investment option is NPS or National Pension Scheme. It is deposited keeping the retirement in mind . People can deposit on a monthly basis or lumpsum, but it will be withdrawable only upon retirement. Government also provides tax rebate under Section 80CCD of the Income tax Act upto Rs.50000 in a year . If we total the amount in tax free investments ,it will come around 225000 (150000 +50000 +25000).

Seventh investment option is gold . Some part of the portfolio should also be kept as gold. It is all time favorite and the price is always increasing.

The eight last investment option is real estate or property. Land or property is the best investment and the price is always increasing. The only demerit in this assest class is liquidity. If someone has to buy land ,it requires a huge sum of money and if someone is in need of money the owner cannot sell it . It is also possible that he may have to sell at a loss instead of profit because the buyers are not always available .

For getting your portfolio reviewed for free you can contact me on [email protected]

Fill the form to know more

[…] There are some options like health insurance and mutual fund which help a lot in achieving financial freedom. I have written a article on it. You can read it here https://sidworld.in/8-best-places-for-investment-in-india/ […]

you’re really a good webmaster. The website loading speed is amazing. It seems that you are doing any unique trick. Also, The contents are masterwork. you have done a great job on this topic!

I think other web-site proprietors should take this website as an model, very clean and wonderful user genial style and design, as well as the content. You’re an expert in this topic!

Hi my friend! I want to say that this article is amazing, nice written and include approximately all important infos. I抎 like to see more posts like this.

Aw, this was a really nice post. In thought I wish to put in writing like this additionally ?taking time and precise effort to make an excellent article?however what can I say?I procrastinate alot and certainly not appear to get something done.

I am extremely impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the excellent quality writing, it抯 rare to see a nice blog like this one today..

One thing is one of the most typical incentives for using your credit card is a cash-back or even rebate supply. Generally, you’ll get 1-5 back upon various expenditures. Depending on the cards, you may get 1 in return on most buying, and 5 back on buying made from convenience stores, filling stations, grocery stores plus ‘member merchants’.

In line with my study, after a property foreclosure home is available at a sale, it is common to the borrower in order to still have a remaining unpaid debt on the financial loan. There are many loan companies who aim to have all fees and liens paid back by the following buyer. Nevertheless, depending on certain programs, restrictions, and state legislation there may be many loans which aren’t easily fixed through the switch of lending products. Therefore, the responsibility still lies on the client that has received his or her property foreclosed on. Thank you sharing your opinions on this site.

Definitely, what a splendid website and illuminating posts, I definitely will bookmark your site.Have an awsome day!

Wow! Thank you! I permanently wanted to write on my website something like that. Can I include a portion of your post to my website?

I’m really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it抯 rare to see a great blog like this one today..

Hi, i think that i saw you visited my weblog thus i came to 搑eturn the favor?I’m trying to find things to enhance my site!I suppose its ok to use some of your ideas!!

I’m a little unsure about your explanations?

Great in theory-quite possibly doomed to fail in practice, sorry..

[…] HSsEFLGPoxgceHIBAaKRABZJorvZ4X […]

I have to show some appreciation to you for rescuing me from this type of situation. Because of researching throughout the the web and obtaining solutions which are not pleasant, I figured my entire life was well over. Living devoid of the approaches to the difficulties you have fixed by means of this post is a crucial case, and those that might have negatively damaged my entire career if I hadn’t encountered your blog. Your good talents and kindness in maneuvering almost everything was invaluable. I am not sure what I would have done if I had not discovered such a stuff like this. I’m able to now relish my future. Thanks a lot so much for this skilled and amazing guide. I won’t be reluctant to recommend your web page to any person who should receive counselling on this issue.

[…] ldRHLH6mFev4wSgk5jVPSyd0ECx7BJ […]

[…] ldRHLH6mFev4wSgk5jVPSyd0ECx7BJ […]

NEVER quit moving. Succeed!

Thanks for the suggestions you have shared here. Something important I would like to express is that laptop memory specifications generally increase along with other improvements in the technological innovation. For instance, as soon as new generations of processors are introduced to the market, there’s usually an equivalent increase in the size and style demands of all computer memory in addition to hard drive room. This is because the software program operated simply by these processors will inevitably boost in power to take advantage of the new know-how.

I抦 impressed, I need to say. Really not often do I encounter a weblog that抯 each educative and entertaining, and let me inform you, you could have hit the nail on the head. Your thought is excellent; the problem is one thing that not sufficient people are talking intelligently about. I am very pleased that I stumbled throughout this in my seek for something relating to this.

Hey There. I found your blog using msn. This is a really well written article. I抣l make sure to bookmark it and come back to read more of your useful information. Thanks for the post. I will definitely comeback.

whoah this blog is great i love reading your posts. Keep up the good work! You know, lots of people are searching around for this information, you could help them greatly.

A few things i have constantly told men and women is that when you are evaluating a good online electronics retail outlet, there are a few issues that you have to consider. First and foremost, you should really make sure to look for a reputable and also reliable retailer that has got great assessments and rankings from other individuals and market sector analysts. This will ensure that you are getting through with a well-known store that provides good assistance and assistance to their patrons. Many thanks sharing your ideas on this site.

I used to be instructed this Internet site by my cousin. I’m not sure irrespective of whether this publish is created by him as not a soul else know these kinds of specific about my issues. You’re excellent! Thanks!

Great ?I should definitely pronounce, impressed with your web site. I had no trouble navigating through all tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Excellent task..

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

Thank you for writing this post. I like the subject too.

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

Please tell me more about your excellent articles

May I request that you elaborate on that? Your posts have been extremely helpful to me. Thank you!

I don’t normally comment but I gotta say appreciate it for the post on this perfect one : D.

Hello sidworld.in administrator, You always provide great examples and real-world applications.

May I have information on the topic of your article?

Thank you for sharing this article with me. It helped me a lot and I love it.

Thank you for being of assistance to me. I really loved this article.

Can you write more about it? Your articles are always helpful to me. Thank you!

Thank you for writing this article. I appreciate the subject too.

Congratulations on a great post! I’ve found that incorporating the customer retention strategies from cashflowlifestyle.net has really helped me to boost my online sales.