Mutual funds in India have come in the limelight in the past 7 to 8 years . It has increased after government started campaigning as Mutual fund sahi haihttps://www.youtube.com/c/MutualFundsSahiHai

I hope this post helps you in reaching your goal of financial freedom with your existing job and resources.

The mutual fund industry in India can be understood by the fact that in US, as of 2019, there where more than 8000 mutual funds compared to 44 in India. The industry size of mutual funds in US is of 22 trillion dollars compared to 37 lakh crore in India.

It means only 15 % people invest in mutual funds. In figures, only 2 crore people invest in mutual funds. In number of agents also there are only 1.25 lakh compared to 13 lacs agents of LIC. The industry has huge scope both for job seekers and investors. New companies have entered in mutual fund like NJ Wealth, Samco Mutual Fund and Navi Mutual Fund . I am providing a list of all the mutual fund houses in India along with their websites.

1. BOI AXA Investment Managers Private Limitedhttps://www.boimf.in/

2. Canara Robeco AMC Limitedhttps://www.canararobeco.com/

3. Union Asset Management Co private limited (formerly Union KBC AMC Private Limited)https://www.unionmf.com/index.aspx

4. IDBI AMC Limitedhttps://www.idbimutual.co.in/

5. UTI Asset management limitedhttps://www.utimf.com/

6. IIFCL AMC LTDhttps://iifclmf.com/

7. LIC MF AMChttps://www.licmf.com

8. DSP MF LTDhttps://www.dspim.com/

9. EDELWEISS AMC LTDhttps://www.edelweissmf.com/

10.Navi Mutual Fund https://www.navimutualfund.com/

11. SBI Mutual Fund https://beta.sbimf.com/

12.BARODA Asset Management India Limited (formerly Baroda Pioneer Asset Management Company limited)https://www.barodabnpparibasmf.in/

13.IDFC AMC LTDhttps://idfcmf.com

14. IL&FS INFRA AMC LTDhttps://www.ilfsinfrafund.com/

15. Indiabulls AMC limitedhttps://www.indiabullsamc.com/

16. ITI AMC limitedhttps://www.itiamc.com/home

17. J M Financial AMC limitedhttps://www.jmfinancialmf.com/

18.Kotak Mahindra AMC Limitedhttps://www.kotakmf.com/

19. L&T Investment Management Limitedhttps://www.ltfs.com/

20. Mahindra AMC private limitedhttps://www.mahindramanulife.com/

21. Motilal Oswal AMC Limitedhttps://www.motilaloswalmf.com/

22. PPFAS AMC Private Limitedhttps://amc.ppfas.com/

23. Quantam AMC Private Limitedhttps://www.quantumamc.com/

24.Sahara AMC Private Limitedhttp://www.saharamutual.com/

25.Shriram AMC Limitedhttps://www.shriramamc.in/

26.SREI MF AMC PRIVATE LIMITEDhttps://www.srei.com/srei-mutual-fund-asset-management-private-limited

27. SUNDARAM AMC Limitedhttps://www.sundarammutual.com/

28.TATA MF/www.tatamutualfund.com

29.TAURAS AMC Limitedhttps://www.taurusmutualfund.com/

30. Whiteoak Capital AMChttps://mf.whiteoakamc.com/

31.BNP PARIBAS AMC India Private Limitedhttps://www.barodabnpparibasmf.in/

32.Franklin Templeton AMC Private Limitedhttps://www.franklintempletonindia.com/

33. HSBC AMC India Private Limitedhttps://www.assetmanagement.hsbc.co.in/en

34.Invesco AMC India Private Limitedhttps://invescomutualfund.com/

35.Mirae Asset Global Investments (India) Private Limitedhttps://www.miraeassetmf.co.in/

36. PGIM India AMC Private Limitedhttps://www.pgimindiamf.com/

37. Principal AMC Private Limitedhttps://www.principalfunds.com/

38.Aditya Birla Sun Life MFhttps://mutualfund.adityabirlacapital.com/

39.Axis AMC Limitedhttps://www.axismf.com/

40.HDFC MFhttps://www.hdfcfund.com/

41.ICICI PRUDENTIAL MFhttps://www.icicipruamc.com/

42. NIPPON MFhttps://mf.nipponindiaim.com/

43.QUANT Money Managers Limitedhttps://quantmutual.com/

44. IIFL Asset Management Limitedhttps://www.iiflmf.com/

45.Samco Mutual Fundhttps://www.samcomf.com/

46.N J Mutual Fundhttps://www.njmutualfund.com/

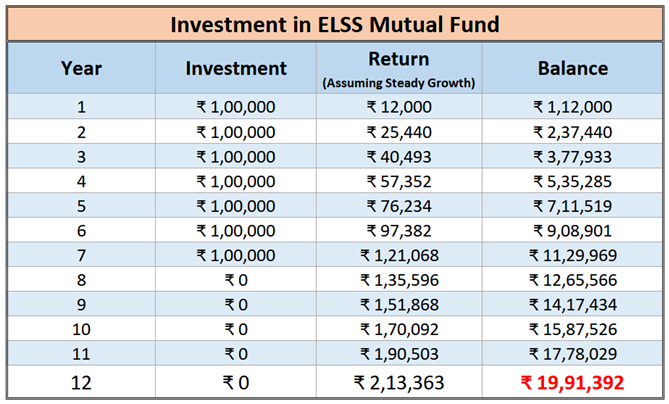

Mutual Funds, in simple words can be understood by the returns they generate over a relatively long period of time. For example, in 1996 a scheme was launched by Aditya Birla Sun Life MF by the name of Aditya Birla Sun Life Tax Relief ’96. If someone invested 1 lakh in this scheme, it would have become 1.52 crore over a period of 23 years. Now, how did this happen?

The simple answer is that the investment in mutual funds gives you compound interest compared to simple interest in fixed deposits. SIP is another way of investing in mutual funds.

It means that you allocate a fixed amount like 1000 or 2000, or any amount you like to be deducted from your bank account to the mutual fund scheme on a regular basis. This is to be continued on a long term basis if you want to achieve your goal. Your goal can be anything like, early retirement, your child’s education, your daughter’s marriage, your own house, etc.

Some mutual funds also offer additional benefits like term insurance cover in addition to your monthly investments. For example, in ICICI MF, you get insurance coverage of 100 times the amount you invest per month in SIP. For first year it is 10 times the amount, in second year,, it is 50 times. Now such service has been stopped by the fund houses.

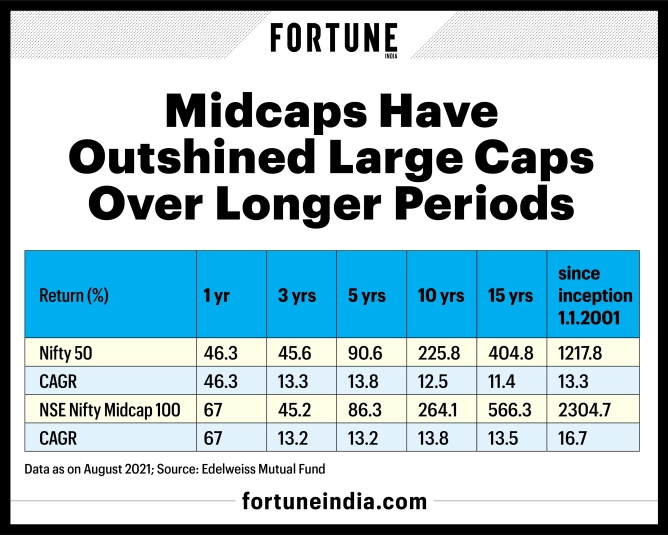

There are also various schemes in Mutual Funds like large cap fund, mid cap fund, small cap fund, banking fund and others. Large cap fund means the mutual fund will invest in top 100 companies by market capitalization. This has a relatively low risk and can be preferred by people of young age.

There is also dividend income in mutual funds. The fund houses on a regular basis distributes the profits of the fund as dividends. This also adds to the fund value if it is not taken out by the investor.

In addition to the value provided by the mutual fund to the investors ,it is also a great source of income for the distributers. Since mutual funds have been in focus recently ,the number of distributors is very less compared to life insurance agents. According to the data, India has 1.18 lakh mutual fund agents till December 2021 compared to 25 lakh life insurance agents in India.

The income of mutual fund agent is more than the life insurance agent but the structure is completely different. In mutual fund , the commision keeps on increasing gradually but in insurance it start decreasing. The commision is fixed for insurance agent but it keeps on changing in mutual fund.

This is because the value of funds keeps changing according to the market conditions whereas in insurance the returns are fixed so ,commision can be determined exactly.

At present here is a list of 10 mutual fund schemes which are performing very well.

1.Nippon India Growth Fund

2. Parag Parikh Flexicap Fund

3.Aditya Birla Digital India Fund

4.Axis Bluechip Fund.

5.HDFC Flexicap Fund

6.Edelweiss Largecap Fund

7.ICICI Transportation and Logistics Fund

8.ICICI Balanced Advantage Fund

9.Kotak Smallcap Fund

10.Mirae Asset Bluechip Fund

These schemes have performed very well in the past year despite tough market conditions.

Please comment below if you have liked the article and you can reach out to me on siddharth@sidworld . You can also check my other articles .https://sidworld.in/

Hi sidworld.in owner, You always provide valuable feedback and suggestions.

At Assetplus, we believe that everyone should have the opportunity to achieve their financial goals. Become a mutual fund distributor offers a wide range of investment options, including mutual funds, stocks, bonds, and more.